- Department of Neurosurgery, Loma Linda University, Loma Linda, California, United States.

DOI:10.25259/SNI_230_2020

Copyright: © 2021 Surgical Neurology International This is an open-access article distributed under the terms of the Creative Commons Attribution-Non Commercial-Share Alike 4.0 License, which allows others to remix, tweak, and build upon the work non-commercially, as long as the author is credited and the new creations are licensed under the identical terms.How to cite this article: Daniel John DiLorenzo. Societal return on investment may greatly exceed financial return on investment in neurotechnology-based therapies: A case study in epilepsy therapy development. 19-Apr-2021;12:180

How to cite this URL: Daniel John DiLorenzo. Societal return on investment may greatly exceed financial return on investment in neurotechnology-based therapies: A case study in epilepsy therapy development. 19-Apr-2021;12:180. Available from: https://surgicalneurologyint.com/?post_type=surgicalint_articles&p=10727

Abstract

Background: This research study is an economic analysis of a neurotechnology-based translational research and development venture focused on the development of a therapy for patients with epilepsy. In the conceptualization, planning, financing, and execution of neurotechnology ventures, many factors come into play in determining value and ability to secure financing at each stage of the venture. Conventionally, these have included factors that determine the return on investment for the stakeholders of the venture, most notably the investors and the team members, the former investing hard earned capital, and the latter investing significant portions of their professional careers. For a variety of reasons, the positive impact on society is often not quantified and taken into consideration.

Methods: To address this, a new term is defined and assessed at a first approximation level using an index technology. The metric is termed the societal return on investment (sROI).

Results: Among chronic conditions, neurological disease is virtually unique in the magnitude of economic devastation that it can inflict on a person and a family. Because the device costs do not reflect this value that is lost and subject to restoration, these are missing from this important calculation. The index project is the development of a seizure advisory system, which cost $71.2 million to develop and conduct a First-In-Man (FIM) study (NCT01043406) and which was estimated to require $50 million to complete a pivotal study.

Conclusion: Despite the immense costs required to develop, test, and commercialize such a system, the direct and indirect economic costs imposed by uncontrolled seizures are sufficiently staggering that a sROI becomes positive after only 400 patients have been successfully treated and returned to work.

Keywords: Chronic monitoring, Economics, Epilepsy surgery, Finance, Intracranial electrodes, Intracranial monitoring, Medical technology, Neuroeconomics, Neuroengineering, Neurotechnology, Neuroventures, Seizure focus localization, Seizure monitoring, Seizure prediction, Subdural electrodes

INTRODUCTION

Motivation

The development of medical technology is fueled by private investment. This has brought innumerable lifesaving and quality of life-enhancing innovations, spanning antibiotics, antihypertensives, antidepressants, antiepileptic drugs, surgical tools and sterilization technologies, cardiac stents, CT and MRI machines, surgical microscopes, pacemakers, spinal cord stimulators, deep brain stimulators, other invasive and noninvasive neuromodulation technologies, and a seemingly endless list of technologies and products that we take for granted. Each began with an idea, consumed years to decades of focused effort and thousands to millions or even billions of dollars in capital to transform from a nascent concept into a safe and effective medical technology and therapy.

This represents one of the spectacular benefits of a free market. If there is a pain point for a customer or a patient, then there is value in creating a solution. The larger the pain, the larger the value, at least in traditional free market economics. If a technology or product solves a problem for a customer or patient, then the free market would support charging a price that a customer is willing to pay to eliminate that pain. This figurative pain occupies a spectrum of disease specific symptoms or features, such as literal pain in chronic pain, affective pain or discomfort in depression, loss of reality testing in bipolar disorder and schizophrenia, loss of a variety of functions in stroke and of sensorimotor function in spinal cord injury, and loss of predictable functionality, consciousness, and often employability in epilepsy.

In many free markets, the product price is set by the market and is related to the value that the paying customer places on the product. For many medical technologies, the patient is taken out of the loop in the pricing and market dynamics. With the introduction of various forms of health insurance into the market, artificial perturbations to the free market dynamics are created:

Removal of patient from the financial aspects of decision making, including valuation, negotiation, pricing, and responsibility. This had the desirable benefit of providing access by patients to technologies and products that they could otherwise not afford. By removing patients from the financial dynamics, this also had the simultaneous drawback of allowing payors to place their own valuations on products, and in doing so, potentially precluding access. If a price or payment is too high, the bar to achieving access may be unduly stringent. If the reimbursement or payment is too low, then the company providing the product may discontinue it, opt out of unfavorable contracts or networks, or go out of business, each of which limits patient access to products. Concentration of pricing power into the hands of a small number of entities, including government entities (i.e., CMS) and insurance companies. These entities do not directly or indirectly receive or benefit from the value provided by the medical products, and their primary objective is cost containment. Consequent discrepancy between the value delivered to the patient and the price paid for the product. In many conditions, the value of a device, drug, or surgical procedure realized by the patient far exceeds the price paid for the device and/or surgery. At first glance, this may seem good for the patient while bad for the technology company developing the products or the physician delivering the service; however, this discrepancy can be detrimental to the patients as well by limiting access to therapies and products.

Downward pressures on reimbursements undoubtedly throttle back innovation, requiring the developing ventures to complete the R&D, preclinical and clinical studies, and commercialization efforts on a smaller amount of capital. Although this force drives capital efficiency, this also renders many therapy and product development efforts impractical, and during actually or potentially tight financially periods, many beneficial medical technologies are shelved and do not receive funding.

MATERIALS AND METHODS

Index indication and technology: Epilepsy

Demographics

The prevalence of epilepsy in the United States is 1.2%,[

Scope of the problem

Anxiety due to the unpredictability of seizures, more so than the ictal event itself, presents a substantial impediment for patients with epilepsy.[

Impact – Personal

The most impactful effect of epilepsy on patients is the loss of control. This can impose restricted independence and may preclude driving. Furthermore, at least partially attributable to the loss of control, common among patients with epilepsy are secondary psychiatric disease. Consequently, the person may suffer from impaired employability. Restoration of independence, as could be achieved by seizure freedom and/ or seizure prediction, could restore and preserve employability, fundamentally changing the economic impact of epilepsy on patients. Quality of life, lifespan, and mortality are important personal considerations and are reflected in metrics such as DALY and quality-adjusted life years (QALY). Inclusion of these metrics would likely further increase an sROI calculation if included; however, they introduce some subjectivity with the valuation of a life year. For clarity, this analysis is restricted to the direct and indirect economic costs, which alone provide compelling rationale for more investment as a society in the development of more neurotherapeutic technologies.

Impact – Economic

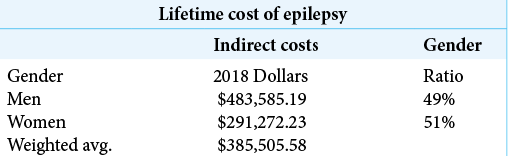

Lifetime indirect cost for male and female patients with epilepsy was studied and published by Begley et al. in 2000.[

Case study: Seizure prediction

As a case study, the estimated development costs for the NeuroVista Seizure Advisory System[

This is a conservative estimate for several reasons.

The dollars used in the Begley 2000 study are 1995 dollars. The dollar estimates for device development are distributed from 2004 to 2013. If one were to convert the 1995 dollars used by Begley into 2010 dollars as an approximately median dollar representing those used in the NeuroVista R&D effort, the conversion is $100 in 1995 which has buying power equivalent to $148.03 in 2010.[ These costs are averages for all patients with epilepsy. Approximately 2/3 of patients with epilepsy achieve seizure control with medications, and many of these patients are gainfully employed. The weighted average of the indirect costs uses estimates for women which are substantially lower than those for men. Since the time that the data used in Begley 2000 was collected, the proportion of women in the workforce has increased; so, the wages lost for women and the indirect weighted average cost should be expected to increase correspondingly. This does not take into consideration the potential reduction in direct costs, such as antiepileptic drugs, hospital admissions, and other health care-related expenses, that could be reduced by a device which predicted or controlled seizures. Belgey et al., 2000, estimated the direct costs to be $6429 over a 6-year follow-up period.[

RESULTS

Internal return on investment (IRR)

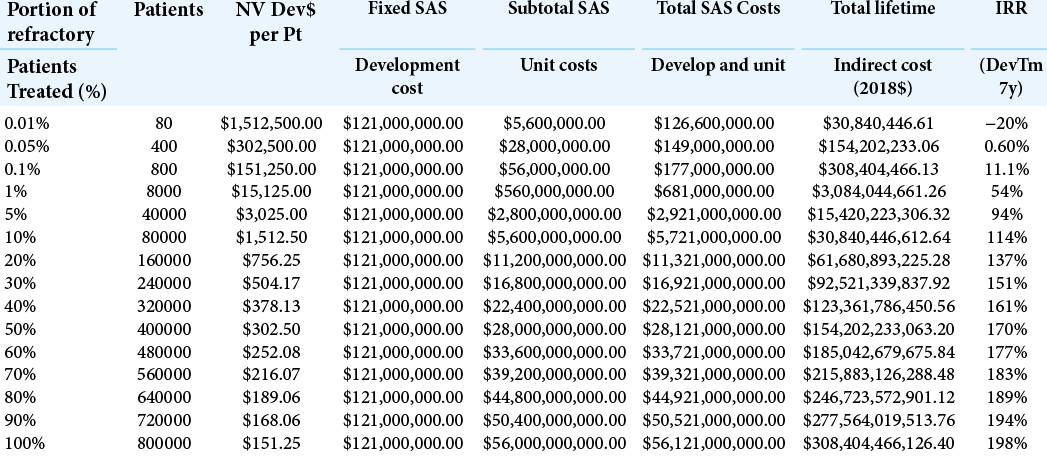

For the index case, the NeuroVista SAS, the development costs are estimated to be $121 million, comprising the $71.2 million spent on the algorithm and device development and the First-In-Man (FIM) study[

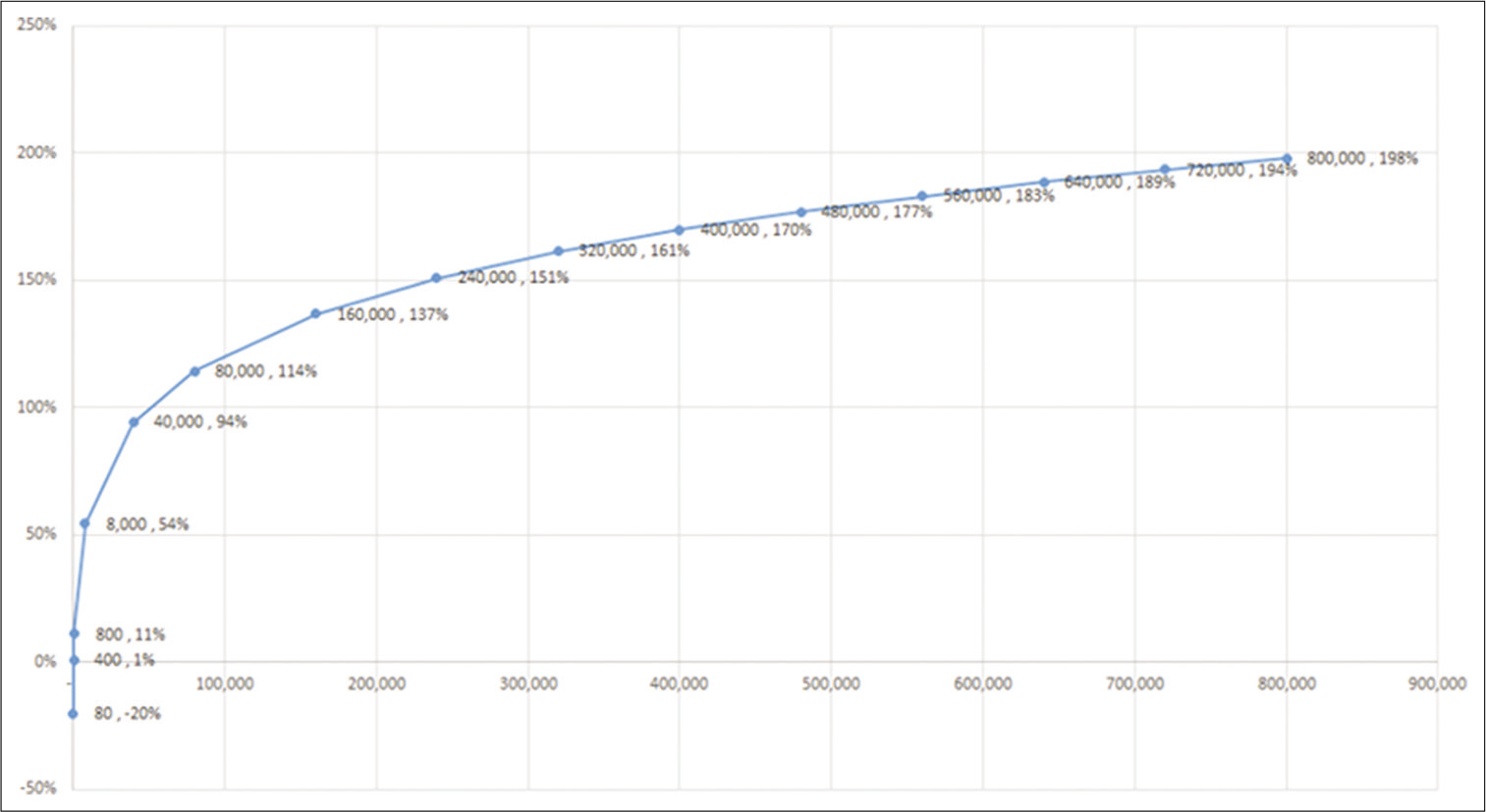

Calculation of the IRR as a function of number and percentage of medically refractory patients treated is shown in [

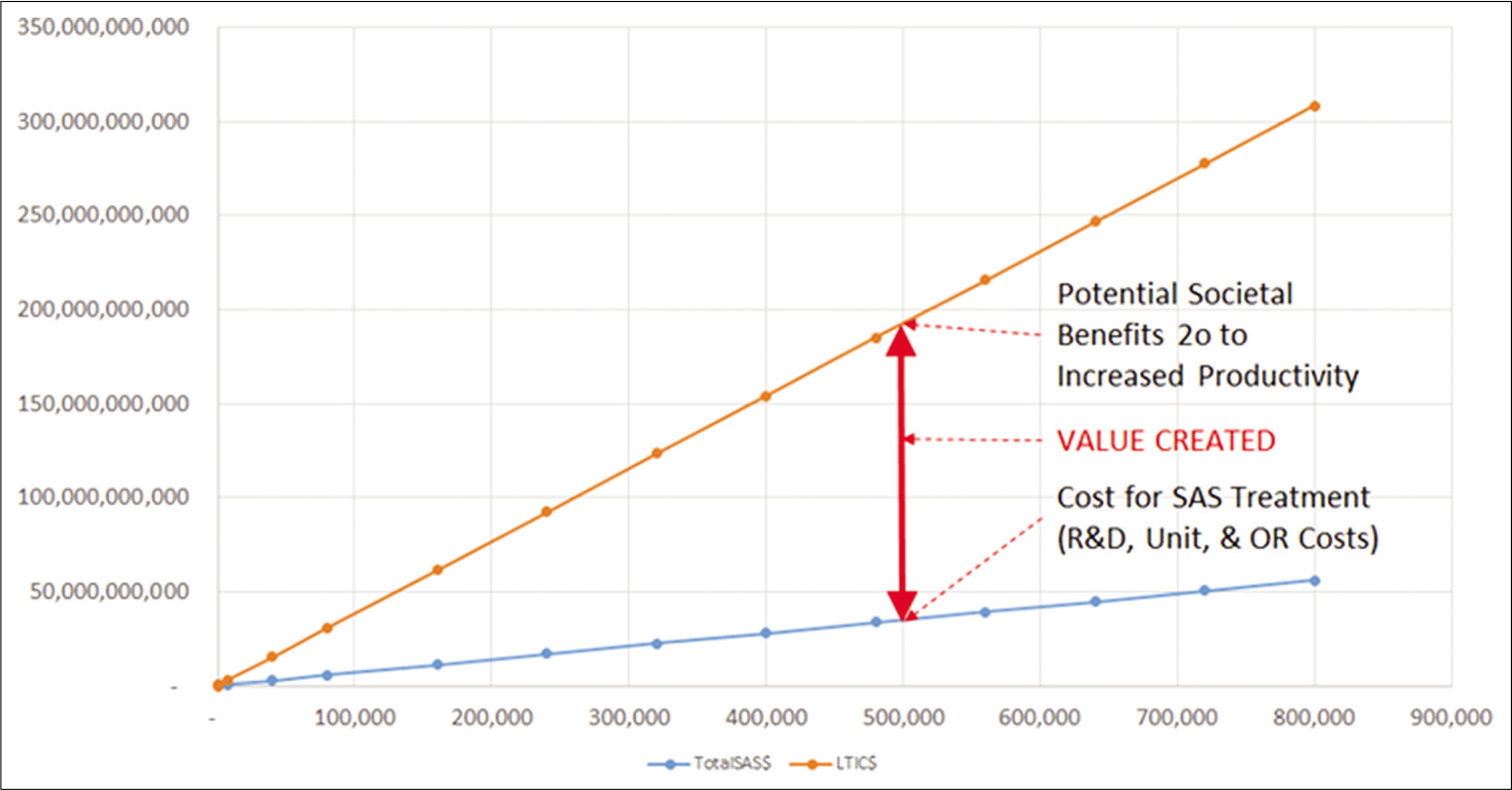

This same information is shown graphically in [

In [

DISCUSSION

In this brief analysis, using first approximations for the costs and the benefits of a promising potential therapy for epilepsy, the return on investment at a societal level, termed the societal return on investment (sROI), is proposed and calculated using an index technology. Because of severe downward pressures on prices of devices and therapies for medical conditions, and the limited abilities of individuals to pay prices that might reflect the actual value delivered, free market forces are constrained in this field. Because there may be significant benefits to individuals and to society as a whole that are not reflected in the device pricing, there exists a potential loss to patients and to society that may not be recognized if and when devices and therapies are not commercialized due to the apparent insufficient ROI to investors. This is not a judgmental statement since individual and institutional investors have a fiduciary responsibility to invest wisely and to deliver a return to themselves, their families, and their limited partners. In the approval and reimbursement process, it may be beneficial from a societal standpoint to calculate an sROI and to provide incentives to favor the development of worthwhile therapies that otherwise might not receive or be able to secure funding for development. Some regulatory relief, access to augmented reimbursement funding, and possible tax incentives may be mechanisms by which the development and commercialization of safe, efficacious, and worthwhile therapies may be facilitated. This analysis represents only one such technology; similar arguments may be made for treatments for other devastating conditions, such as those for paralysis, schizophrenia, Alzheimer’s disease, and others that significantly impact the ability to live independently, the economic productivity, and the quality of life of the individual.

CONCLUSION

Devising mechanisms by with the societal return on investment (sROI) may be factored into investment decisions in neurotechnology and other therapeutic technologies could substantially increase both the availability of and patient access to life changing technologies. Further work on exploring and implementing such mechanisms is warranted.

Declaration of patient consent

Patient’s consent not required as patients identity is not disclosed or compromised.

Financial support and sponsorship

Nil.

Conflicts of interest

There are no conflicts of interest.

References

1. Begley CE, Famulari M, Annegers JF, Lairson DR, Reynolds TF, Coan S. The cost of epilepsy in the united states: An estimate from population-based clinical and survey data. Epilepsia. 2000. 41: 342-51

2. Cook MJ, O’Brien TJ, Berkovic SF, Murphy M, Morokoff A, Fabinyi G. Prediction of seizure likelihood with a long-term, implanted seizure advisory system in patients with drug-resistant epilepsy: A first-in-man study. Lancet Neurol. 2013. 12: 563-71

3. DiLorenzo DJ, Leyde KW, Kaplan D. Neural state monitoring in the treatment of epilepsy: Seizure prediction-conceptualization to first-in-man study. Brain Sci. 2019. 9: 156

4. DiLorenzo DJ. NeuroVista: Concept to first-in-man: A war story behind launching a venture to treat epilepsy. Surg Neurol Int. 2019. 10: 175

5. Fisher RS. Epilepsy from the patient’s perspective: Review of results of a community-based survey. Epilepsy Behav. 2000. 1: S9-14

6. Inflation Calculator: U. S. Inflation Rate $100 in 1995 to 2010-2019. 2019. p.

7. .editors. Epilepsy Across the Spectrum: Promoting Health and Understanding. Washington, DC: The National Academies Press; 2012. p.

8. Murray CJ, Vos T, Lozano R, Naghavi M, Flaxman AD, Michaud C. Disability-adjusted life years (DALYs) for 291 diseases and injuries in 21 regions, 1990-2010: A systematic analysis for the global burden of disease study 2010. Lancet. 2012. 380: 2197-223

9. Vickrey BG, Hays RD, Rausch R, Sutherling WW, Engel J, Brook RH. Quality of life of epilepsy surgery patients as compared with outpatients with hypertension, diabetes, heart disease, and/ or depressive symptoms. Epilepsia. 1994. 35: 597-607

10. Zack MM, Kobau R. National and state estimates of the numbers of adults and children with active epilepsy-United States 2015. MMWR Morb Mortal Wkly Rep. 2017. 66: 821-5