- Departments of Neurosurgery and Biomedical Sciences, Loma Linda University, Loma Linda, CA, USA.

DOI:10.25259/SNI_422_2019

Copyright: © 2019 Surgical Neurology International This is an open-access article distributed under the terms of the Creative Commons Attribution-Non Commercial-Share Alike 4.0 License, which allows others to remix, tweak, and build upon the work non-commercially, as long as the author is credited and the new creations are licensed under the identical terms.How to cite this article: Daniel J. DiLorenzo. Neurovista: Concept to first-in-man: The war story behind launching a venture to treat epilepsy. 13-Sep-2019;10:175

How to cite this URL: Daniel J. DiLorenzo. Neurovista: Concept to first-in-man: The war story behind launching a venture to treat epilepsy. 13-Sep-2019;10:175. Available from: http://surgicalneurologyint.com/surgicalint-articles/9644/

Abstract

Many medical (and nonmedical) technologies are the fruit of years and even decades of work by dedicated members of startup companies and commitment of capital by their investors. The launching of a medical device venture is fraught with many risks, but the personal, societal, and potential financial rewards of developing therapies that improve the lives of others makes the risk and sacrifice worthwhile. The litany of risks and challenges can be daunting, and persistence is the key ingredient to every incremental iota of success achieved. This is a personal war story behind the launching of a medical device venture that developed an implanted seizure prediction system (NCT01043406). The intent is to share the experience so that others with interest in the field may learn from the experience and also decide whether such an endeavor is something that they want to undertake.

Keywords: Entrepreneurship, Epilepsy, Innovation, NeuroVista, War story

INTRODUCTION

I was asked to write this manuscript by Dr. James Ausman after giving a talk at a Loma Linda University Department of Neurosurgery research symposium. This talk evolved from a series of talks I was asked to give in a variety of clinical, engineering, and industry venues on the founding of what became NeuroVista. In giving similar presentations on the topic of NeuroEngineering and NeuroVentures in a number of contexts, the hope has been that it will have both entertainment and educational value for those who have interest in launching entrepreneurial ventures or developing technologies with medical applications. It is my goal to present as realistic of a picture as possible, within the although brief scope of a manuscript, to the readers about the undertaking of developing a complex implantable medical device, the challenges the pitfalls, the inspiration, the insights, and pearls learned along the way in the hopes that this may have inspirational value to some and may also make the arduous road of innovation and entrepreneurialism just a bit easier for those about to undertake the journey…

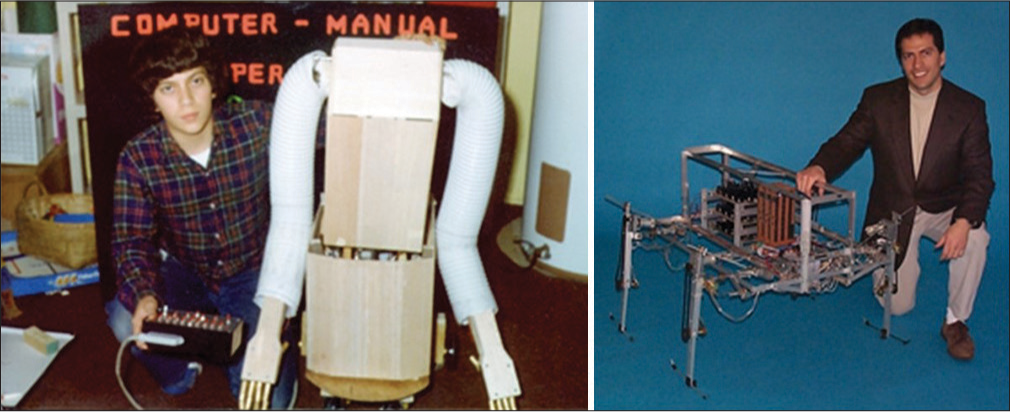

BACKGROUND AND MOTIVATION: GRADE SCHOOL AND HIGH SCHOOL

All journeys have a beginning, and the seeds for this one really began back in grade school. The journey has not ended, and it is my hope that this represents only one of many chapters, each perhaps building on the previous ones. As a young boy, I had an insatiable fascination with building things, particularly things that had some mechanical or electrical complexity and that had biological relevance. I could work for hours uninterrupted on building models of airplanes, ships, spacecrafts, and anything else I could get my hands on. As for many with an engineering bent, this progressed to an interest in electrical circuits and mechanical devices. In middle-grade school, I got my hands on as many books on electronics and electrical project kits as I could; and I built every single circuit that was described in all of the books and kits. With some insights gained this experience, I began designing analog and digital circuits of my own. The circuits became progressively more complex and interesting and in fifth grade included an infrared voice transceiver for my first science fair project. In sixth grade, I built a programmable read-only memory which used individual diodes, the presence or absence of which represented a one or zero bit, to program the memory. For seventh grade, I built in automatic memory scanner and an output device which was a tone generator, allowing one to program synthetic music into the memory. In my description of practical applications for this memory and scanner, I suggested that this could be used to control a robot. For the next year in eighth grade, I decided to build that robot. I had no idea how to go about it, but I had a year to figure that out. That experience alone could really be the topic of a book… The successes, the failures, the heartbreaking setbacks, the insights, several selfless mentors, the unconditional support of my parents and family, and the resounding lesson that everything boils down to persistence, were formative experiences in my life. This pursuit was successful, and an 11-degree-of-freedom anthropomorphic wheeled mobile robot with bimanual five-fingered hands with opposable thumbs with a programmable read-only memory-based digital controller emerged just in time for the eighth-grade science fair. Persistence won. My brother Mike confided to me afterward that when I said I wanted to build a robot he tried not to laugh, but when I completed it, he said there’s nothing Dan cannot do. I remember those words vividly. The top 10 elements contributing to success were all the same: persistence. Beyond the lesson of persistence, this experience crystallized in me the passion to combine engineering in medicine and the goal to make an impact in the world by developing medical therapies. In each of my subsequent 4 years of high school, I built successively more sophisticated robots, culminating in a closed-loop digitally controlled 11 degree-of-freedom anthropomorphic wheeled mobile robot in 11th grade and a manually controlled 12 degree-of-freedom four-legged walking robot in 12th grade [

COLLEGE AND GRADUATE EDUCATION

Realizing the importance and synergy of electrical and mechanical engineering, I studied both subjects, earning electrical engineering degrees at the bachelors and Masters level and mechanical engineering degree at the PhD level, all at MIT. Seeking to obtain a broad research experience relevant to developing useful technologies, I worked on four projects related to neural prostheses. These included (1) functional electrical stimulation for gait restoration for paralyzed patients, (2) development of an implanted peripheral nerve interface for providing sensory feedback from an artificial limb to the nerve in a stump of an amputee, (3) microfabricated electrode array design and development for retinal stimulation for blind patients, and (4) analyses of neural firing patterns during brain control of limb movement, relevant to current brain-computer interfaces. Because of my desire to develop technologies for clinical use and to bring them to the market and to patients, I earned an MBA (Masters of Science in the Management of Technology), at the MIT Sloan School of Business, concurrent with completing the MD and PhD.

THE SEED AND VENTURE: NEUROMODULATION

The kernel of this venture really began when I was an undergrad studying electrical engineering, when I became convinced that neuromodulation would be a viable therapeutic modality for a variety of neurological conditions. Without dating myself, this was before the innovative Dr. Benabid published his seminal work on DBS. I incubated this thought through the remainder of my undergraduate studies into grad school and this motivated my selection of projects for my PhD. It played a significant role in my decision to switch from a relatively more straightforward project in noninvasive functional electrical stimulation to far more risky, challenging, and interesting project on implantable neural interface development. During this time, it struck me that Parkinson’s disease would be a good initial indication to investigate, and as far back as an undergraduate I was doing literature searches on animal models for Parkinson’s disease to gain a deeper understanding of how to develop such a technology. At that point, back at MIT, there were no projects in this area, but I read on the topic and did subsequently work on chronic neural interfaces in grad school.

MEDICAL SCHOOL, PHD, BUSINESS SCHOOL, AND NEUROSURGICAL RESIDENCY

It was during a 3rd year med school elective rotation in neurosurgery at the Brigham, while speaking with one of the chief residents who asked me what I wanted to focus on for research as a neurosurgeon, I gave a relatively vague answer that I wanted to apply electrical engineering to the nervous system. He immediately responded, “Oh that is what Dr. Benabid is doing for Parkinson’s disease.” I was devastated. I had thought that my idea was entirely novel and that this would be one of my main contributions to the field of medicine. This disappointment was channeled as a motivation to then come up with the next potentially high-impact innovation of engineering in neurosurgery, and I began thinking about the next inflection point in the field. Stemming from my interest and experience in robotics and electromechanical systems, I had chosen to specialize in control theory at MIT and took every single control class that MIT offered in every department that offered control theory. As I thought more deeply about the future of neuromodulation, it became clear to me that closed-loop systems that would offer the possibility of sensing disease state in response to therapy could provide a whole new dimension of safety and efficacy. I started to look into specifically how such systems would be designed and implemented and what kinds of control laws would be most applicable as well as what indications would be most likely to benefit from this new technology. Concurrent with but separate from my graduate research I began designing such a system and thinking about how it would be applied from both a clinical and a business standpoint. This was in the late 1990s, and I was already sufficiently busy with my medical studies, PhD research, and business school classes but felt that this was perhaps my purpose and therefore set aside several hours each week usually in the early evening on a Friday and Saturday before going out, to work on designing this technology. This was the first truly closed- loop neuromodulation system, one which calculated a neural state, including the desired and actual states, the error between the two, and generated neuromodulation signals to drive the error to zero. I saw this as a platform technology with broad application to neurological and psychiatric disease. After several years of consistent and diligent work on this, I designed a system and put together a reasonable business plan for this technology and venture, with epilepsy and movement disorders as the initial applications and markets. Fortunately, MIT is a very reasonable intellectual property policy, and I investigated this and found that since this work was separate from my research and had been done on my own time and with my own very minimal resources, I could retain ownership. I then prepared and filed a patent application on this device, completed my studies at MIT, and then matriculated to a neurosurgical residency program; and after several years, the first patent issued. (In retrospect, now in 2019, as I am writing this, this innovation in closed-loop neuromodulation, which is now the rave at all of the neuro- related meetings, was 10–20 years ahead of its time).[

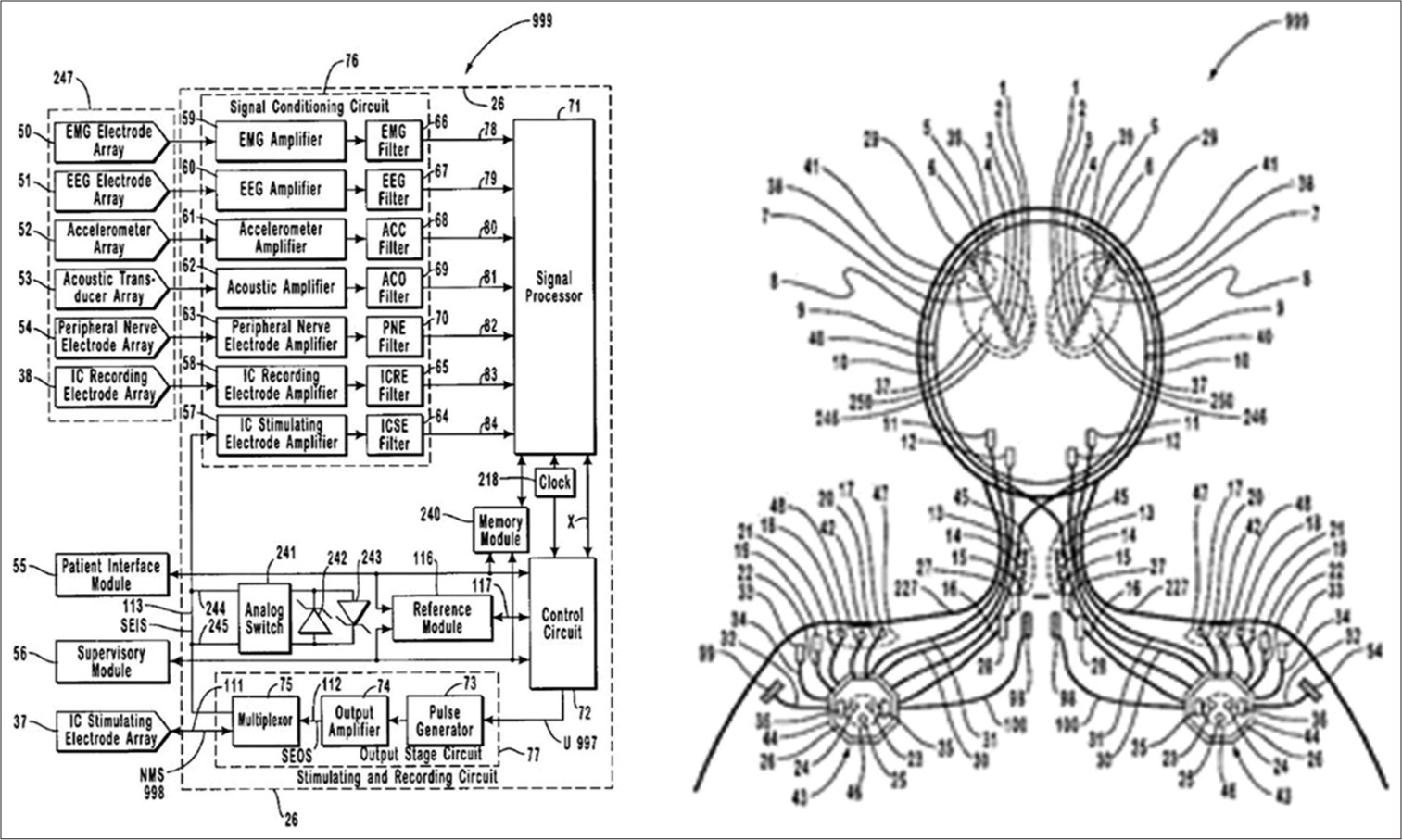

During those 1st years of training, this became a background project, relegated to late-night after getting home from the hospital. The passion for the venture to develop a closed-loop system to treat neurological disease remained alive, and I used the sparse available time to refine the technology and design, augment the IP, and build the network of potential team members, recruits, and investors. The product strategy was narrowed to focus initially on epilepsy, the largest unmet need at that time; and I evolved the design beyond pure feedback driven control to include prediction and control. The approach would involve monitoring brain activity using implanted electrodes, which offered higher signal to noise ratios and higher bandwidths than external electrodes, to sense neural signals, calculate neural states, and deliver modulation to maintain states in desired ranges. A simplified block diagram is shown in

Figure 2:

Intellectual property: Circuit block diagram and anatomical schematic of the initial closed-loop neuromodulation system (filed in 1999).[

NEUROSURGICAL RESIDENCY AND DEVELOPMENT OF PATENTED DEVICE AND COMPANY

Boston and MIT were epicenters of innovation, and during my “tenure” there, I met as many people in the entrepreneurial and technology fields as I possibly could. I had remained in touch with friends and colleagues in the medical device space and in the venture capital field, and the time seemed near for me to be able to raise capital to launch a venture to develop a closed-loop neuromodulation system. At that point (early 2000’s), I was a junior resident, working 120–130 h a week in neurosurgery, so my available time was severely limited. Despite this, I did work 2–3 h a night, about 10–15 h a week, on top of this neurosurgical workload. I won’t say I wasn’t sleep deprived, and I have a fair share of stories, better told in person, from the experience. I was able to make progress, nonetheless; and I put together a team and business plan, entered business plan competitions at Tulane and at MIT. We were finalists in both competitions and took second place at MIT, which historically was the place taken by the most successful companies to be launched so that was encouraging [

Figure 3:

Business plan competition: I recruited a bright and energetic team and entered the venture in the MIT $50K Business Plan Competition, and we took 2nd place, a catalytic event driving a timeline for completion of the business plan and a source of helpful early feedback. (L to R: Anoop Rao, Daniel DiLorenzo, James Petite, Geoffrey Arone).

This was only a brief couple years following the internet bubble stock market crash, and the public market had not yet fully recovered; therefore, venture capital funds were still hesitant to invest in long-term capital-intensive risky ventures. This is somewhat counterintuitive since investment, and financial cycles are by definition cyclical and the value of the market at a given point of time does not necessarily correlate with the status of the market when a company is attempting to exit; however, this behavioral correlation was the reality. The year after that first patent issued, I had a research year during my neurosurgical residency, which afforded far more freedom of both time and schedule than I was accustomed to. Instead of 120 h/week, I could work 60 in the lab and 60 on the venture… and make progress. I used this flexibility to travel to meet with potential recruits to the company and to give presentations to potential investors. The resounding message was that this was a fascinating project; however, its risk, duration, and capital-intensive nature were beyond the appetites of investors at that point in time. The following year when I was back on the neurosurgical service as a junior resident, the stock market picked up considerably. Concurrently, some of the more active early-stage investors in the San Francisco Bay Area and the Boston area started to appreciate, as I had already, that the neuromodulation field would track along the cardiac modulation field and the neuromodulation might be a mainstay of therapy as pacemakers and defibrillators had become. Because of these two concurrent factors, I began getting calls and emails on a near weekly basis from the venture capital funds with whom I had met during the previous year. They each were requesting me to come and give a presentation on the venture that I had been discussing the previous year. It was beyond frustrating since now I was back in the figurative dungeon working a 120–130 h a week with virtually no control over my schedule and yet the recipient of a tantalizing stream of communication from investors interested in the project I had wanted to launch for over a decade. Each email and message was like one droplet of water in a session of Chinese water torture.

BEING A JUNIOR NEUROSURGICAL RESIDENT AND RAISING VENTURE CAPITAL TO FORM A COMPANY

The renewed venture capital interest was just one part of the puzzle. The next step was the politics of getting time off of junior residency to give a pitch to venture capitalists (VC). Furthermore, coordinating with all of the other members of the team, all of whom were busy professionals, including a functional neurosurgeon, a neurologist, an epilepsy researcher, and a VP of engineering at another company, was no easy task. Well aware of the extreme political capital I was going to have to expend to get a couple days off to give this pitch, I made a proposition to the investors just to make sure they were as committed as I was. Since I was a poor neurosurgical resident and was going to burn a lot of political capital in making the trip to meet them, I asked that the VC would show their interest by splitting the travel costs with me. I had never heard of this being done before, but I thought it would be reasonable to ask given the circumstances; and if they were as serious as I was, then this would be well worth the effort and risk. One of my senior residents on service was far from enthusiastic about a junior resident taking time off for anything business related, but fortunately, my chairman, Dr. Donald Richardson, was very supportive. That 1st day off took 5 months to line up. Between my junior resident schedule at the bottom of the totem pole and coordinating with four other professionals, it seemed like the planets were never going to line up. But finally, after about 5 months of trying, in mid-December, I was able to schedule 2 days off. I swapped call with a good friend and fellow resident in order to accomplish this. This was before the days of the hour’s limitations, and I had been up for about 48 h prior to the flight headed for San Francisco.

RAISING VENTURE CAPITAL FROM INVESTORS

When I got home after about 2 days of consecutive call on being up 48 h, I quickly packed and felt absolutely exhausted. In those wee hours of the morning, approximately 5:30 am, I somehow convinced myself that I could really go for a 15-min power nap, and then be able to get some work done on the plane. The bed looked irresistible. I set my two alarms, which are each loud enough to wake the dead, for 15 min from then and lay down expecting to be at least somewhat refreshed when I awoke. When I woke up, I did in fact feel refreshed; however, the refreshment immediately faded into a state of terror when I noticed that it was light outside. My flight left at dawn; it should not be light outside right now. I had slept for almost an hour. My heart raced, and I took the fastest shower I had ever taken, hopped into my Jeep and drove, as fast as the car could possibly go, to the airport. The flight had not taken off yet, but it was dangerously close. I called the airlines while driving, and they had two flights getting into San Francisco slightly before our scheduled meeting. I arrived at the airport ready to chase the plane down the runway. I had planned this so far in advance, the flight I got was around $200, barely affordable on a resident’s meager salary. The cutoff for check into that flight had closed although the flight was still at the airport. I negotiated, or perhaps more precisely begged, that I be given a chance to race through security to the gate in the hopes of making the flight. Not happening. Hence, I bought a ticket for the next flight, which on zero advance notice totaled $1100. The sympathetic nervous system was too revved up to allow any perception of pain to be felt from that outrageous price. I was simply thankful that I had a flight, took the boarding pass, and quickly got on the plane. Fortunately, I left some buffer time in the schedule, and given the sheer amount of time and effort that went into setting this up, the VC partner booked the entire afternoon for us. Meeting still on. Destiny preserved.

Finally, I had nothing between me and my big pitch, except for about 5 h. Between the 1-h power nap and the sheer adrenaline, having been up 48 h seemed irrelevant. I asked the stewardess for 2 cups of coffee and as many cups of ice, mixed them, chugged them, and got to work. The talk had been done but as for all early-stage ventures, it was a work in progress. There were a couple slides that needed some updating. And for the 1st time in months, there was no pager. The first slide update was the risks of the investment. The second was prospective executive candidates. I had accomplished much of this when the battery ran out. This could not be happening. Too much was at stake. It took about 5 s to come up with a solution. I hit the overhead call button, and the stewardess came to my seat. I politely asked if they could make an announcement on the overhead microphone and ask if anybody had Dell Inspiron 8100 computer, and if so, would the person be willing to loan the battery to me for the remainder of the flight. I asked him to offer $25 for the battery rental, and if there were no takers to repeat the offer in 5 min doubling to $50. Several minutes later that announcement came overhead and to my astonishment within a couple minutes somebody came up offering his battery. I thanked him and plugged the battery in to make sure it was compatible with my computer. It was. I reached into my wallet to take $25 out and noticed that the battery was only halfway charged. For a brief second, I considered half in jest to negotiate down to 12 and half dollars; but my gratitude far exceeded that temptation. Hence, I forked over $25, got another 1–2 h of work done, and completed the last two slides. Check.

We landed in San Francisco, met with the team, grabbed a rental car, and headed toward Sand Hill Road. We were seated around the table with the senior partners of one of the well- known active early-stage VC firms, DeNovo ventures. One of their senior partners, Richard Ferrari, opened the discussion with a quotation that I will never forget, “do you realize that sitting around this table represents over half a billion dollars of capital.” I wasn’t fazed and instead thought “good, then were not wasting each other’s time.”

I led off the pitch discussing the market and the unmet need, the pain felt by the customers who in this case were patients with untreated epilepsy, and the acute need for a solution that could offer seizure prediction and control. Each of the team members fielded certain aspects of the discussion, each a world expert in his respective area. We delved into the clinical need, the value and novelty of closed-loop neuromodulation, the challenges and feasibility of implementing the complex system in an implanted piece of battery-powered hardware, the competitive landscape, the uniqueness and strength of our intellectual property, the risks of the venture and the potential returns on the investment, and the capital requirements and timelines. This was an animated and high- energy conversation that lasted over 2 h culminating in a very high level of interest among the investors and request for a follow-up meeting in the very near future. In fact, they asked us to come back to meet with a syndicate that they would put together in 2 weeks. I was dumbfounded. The sheer pain that it took to make this meeting happen with about 5 months of preparation and the political capital that it took to wrestle 2 days off during December were extreme. There was no way I was going to be able to pull us off again in 2 weeks.

This is when it started to become crystal clear to me that simultaneously getting this venture launched and doing junior residency, despite doing 130–140-h work weeks with the consistent business time of 10–15 h/week tacked onto the standard 120–130-h clinical week, was just not realistic. And each month that went by was another month that the competition was out there filing more patents, making progress in their engineering technologies, and raising more money to fuel their ventures. I had to fish or cut bait.

Over the next 3 months, the follow-up meeting and its logistics came together. This time I had to use an entire week’s vacation to block off time for one business day trip. The upside: no more 48 h on call immediately before the flight. Interestingly and fortunately, the investment community in medical technology was relatively concentrated and connected, and since that first presentation, word of our meeting quickly spread to other potential investors in the field. I began receiving calls and emails from friends and colleagues and others inquiring about the venture that I was launching. One good friend from college days, Jim Broderick, who had left clinical medicine become a VC said that he was at cocktail party and heard someone talking about a NeuroVenture out of MIT, and he figured for sure that had to be me. On the second trip, while I was out there, I met with several other investment firms and gave the pitch as well. The level of interest was very high. Investors were starting to finally appreciate what I had seen for the previous 10–20 years and that was that neurostimulation was going to be as big if not bigger than the cardiac stimulation field, notable for pacemakers and defibrillators, had become. Furthermore, the previous stock market crash from the internet bubble had finally recovered, and the financial market had rebounded back to normal; so, the investment climate was becoming quite receptive to a project of this nature and scope.

So began the VC dating game. Several firms floated the notion of term sheets with very reasonable valuations. We began negotiating in earnest multiple term sheets, including valuations and other important features such as investment preferences, ratchet clauses, and other details that were important and many of which were new to me at that time. I tried to be a sponge for advice and reached out to friends and colleagues for mentorship in many of these areas, and all were very generous with their time and knowledge. (I would like to thank and acknowledge David Goodman, Shai Gozani, Ken Morse, the late Richard Norman, and the late Russ Olive for their mentorship and advice during this critical time). There are many strategic considerations involved in selecting term sheets and also subsequently adding potential investors to the syndicates. It is a delicate dance. It is best if investors have invested together previously, and is particularly helpful if they have synergistic philosophies, as I quickly appreciated. Very subtle differences in philosophy can place the syndicate at risk for disintegrating. If one investor pulls out unexpectedly, particularly at the last minute, that can not only kill a deal, but it can kill the funding prospects for a venture. Fortunately, I had developed good relationships and communication with many of the prospective investors, and many of them were forthright with me; and we were ultimately able to navigate these risks.

FORMING A COMPANY TO DEVELOP THE PRODUCT, $70 MILLION DOLLARS, AND TAKING TIME OFF FROM NEUROSURGERY RESIDENCY

After about 3 months of meetings and intense discussions with over a dozen potential investors, we got a very good term sheet from one of the most reputable medical device venture capital firms in the country, Three Arch Partners, founded by Tom Fogarty. The only contingency was IP diligence. This was around the time that I was having discussions with my chairman about the possibility of taking 1–2 years off training to launch this company full-time. Ultimately, taking leave with a reserved spot to which I could return in 1–2 years was not an option. I was committed to launching a neurotechnology venture; the planets had finally lined up, and I was going to make it happen. I would have regretted for the rest of my life not pursuing this opportunity. I withdrew on amicable terms and told Dr. Richardson, my chairman at Tulane, that I would probably need 18–24 months to get the venture up and running; and I would remain in touch about the possibility of resuming after the venture was on solid footing.

PATENT CHALLENGES: FREEDOM TO OPERATE

What may have seemed like an innocuous footnote that being “IP diligence,” became a 5–6-month all-out battle. The investors rightfully appreciated that this was likely an 80+ million-dollar investment, and therefore, the patent landscape was very important. Not only did my patents protect our planned products but also an exhaustive analysis of other companies’ patents was performed to make sure there were no problems with freedom to operate (FTO). I still have binders with almost 3000 pages worth of materials that I digested in this battle. The investors hired an extremely experienced patent attorney with a background in neural implants to perform a first cut analysis. This lasted perhaps a month or two and ended with the conclusion that “Dan is probably correct regarding patent coverage and FTO, but if his company is successful, he is going to be sued anyway.” This triggered phase 2 of the patent diligence. The investors actually hired a nationally known biotech litigator and a major law firm to analyze what would happen in a lawsuit. They combed through other company’s patent portfolios and hurled many hundreds of their claims at our proposed devices. At this point, I had completed my PGY-2 year and was available to focus full-time on this task. Fortunately, the preceding year I took and passed the patent bar; so I was facile in the language of the patent attorneys, and having prosecuted all of the companies patents myself, I understood the details and scope of my patent claims (the legally binding jargon defining what a patent covers) and those of the competition.

DEFENDING THE PATENT CHALLENGES, DEALING WITH LAWYERS

The second phase went on for about 4–5 months and consisted of biweekly meetings with the senior partner, his associate at the biotech litigation firm, representatives from each of the VC firms in the syndicate, and me. It took some negotiating to convince the VCs to let me join in the teleconference discussions, but I felt it was too important to not be part of the conversation; and I made a cogent case that I could add value to the discussions. At each meeting, several dozen claims from competing companies were analyzed and discussed in detail. It took quite a bit of self-control to remain quiet as various claims were discussed as possible threats to my company. At the end of each round of discussion, I was given the floor briefly to opine on why certain claims were invalid or inapplicable to the products. I literally spent about 12–16 h/day every day for each of those 2-week blocks going through the claims that were to be as discussed at the next meeting. This work included finding prior art that invalidated these claims or limited their scope and developing coherent “non-infringement” arguments as to why the claims did not cover the products that we proposed to develop. At the end of this 5–6-month process involving two different patent law firms and over $80,000 spent by the VC firms, the conclusion was that I had a good argument to every single one of the claims we discussed, and these numbered many hundreds.

POSSIBILITY OF FAILURE TO DEFEND POTENTIAL LAWSUIT ON PATENT; LAUNCH OF MEDICAL TECHNOLOGY VENTURE

In summing up the analyses, the senior partner said it is correct that Dan has good invalidity or noninfringement arguments for each one of the hundreds of the claims we discussed; however, if the venture gets sued, he probably still has a 50% chance of losing because only one of those claims has to hold up. I couldn’t believe what I was hearing. There was no way this was the end of the line. I quickly put together an argument for how several of the patents in my portfolio could be used in a potent countersuit against companies who could potentially threaten us. I bolstered this with some additional IP that I licensed into the company. These moves and their accompanying impassioned arguments seemed to keep the momentum alive, by a thread as I learned in retrospect; and then we progressed from the term sheet to the closing documents. This went rather quickly, and before I knew it, we had a deadline and a timeline for closing.

The launching of my first real medical technology venture, a goal I had been working toward for well over a decade, was finally happening. After some extremely last-minute haggling by the VC attorneys about some IP ownership details, which potentially threatened the deal, they signed off on the closing documents less than an hour before the deadline. We all quickly signed and faxed the documents, and the money was wired to our company bank account, $3 million from the East Coast from Canaan Partners and $3 million from the West Coast from Three Arch Partners; and the deal was done! I was fried. That was on par with the stress from my PhD defense. I had recruited John Harris and Kent Leyde to join the venture, and after closing, we all celebrated over several drinks in Seattle.

This was a big milestone. Most prominent VC firms see several thousand business plans each year, and they only fund a handful, on the order of 0.1% of the deals screened. Once funded, the likelihood of subsequent funding is well into the double digits, provided milestones are met. Hence, with closing of the Series A financing, the likelihood of success increased from about 0.1% to potentially tens of percentage points, arguably increasing this probability a hundred-fold.

BUILDING THE MEDICAL TECHNOLOGY VENTURE

We quickly set out to build and launch the venture. The infrastructure for gathering and analyzing electroencephalography (EEG) data was designed and built. We designed clinical studies in recruited many terrific centers to generate high-quality data. We then interviewed and hired experienced epilepsy neurologists to annotate that data. Our engineering team built a massively parallel supercomputer optimized to test features against EEG datasets, a critical step in algorithm development [

Figure 4:

New facilities and Infrastructure. (Left) NeuroBionics office space in Fisher Plaza, adjacent to the Space Needle in Seattle. (Right) Massively parallel supercomputer, named “CASCADES,” comprising hardware and an operating system designed and optimized specifically for testing seizure prediction algorithms on large electroencephalography datasets.

We recruited several experts in algorithm development to join the team. We got a terrific deal at well below market rates for an office lease in Fisher Plaza which was literally in the shadow of the Space Needle, a beautiful area of Seattle. We proceeded to acquire several hundred EEG datasets had them annotated by expert neurologists and divided them into a development dataset in a testing dataset. The algorithm team came up with thousands of potential EEG features that may have predictive value and designed corresponding feature extractors as potential building blocks for the algorithm. These feature extractors were then vetted against the EEG data and narrowed down from many thousands to 288, from which a customized subset of a handful of feature extractors was selected for each patient. The development of the technology is described in more detail in DiLorenzo 2019,[

BACK TO FINISH NEUROSURGERY RESIDENCY AND A SUCCESSFUL FIRST-IN-MAN STUDY

By 2013, 11 years and $71 million after founding, the venture had strong first-in-man data in hand, as published in Cook 2013.[

The strategic deal that was going to fund the pivotal study ended up falling through, and the company and technology were acquired by Cyberonics, an early strategic investor. Much of the technology is being used in the next generation Cyberonics LivaNova devices, including multiple subsystems developed for the SAS, as well as my closed-loop IP covering closed-loop VNS systems. I retain 50% ownership in much of the NeuroVista IP, and 100% ownership of this IP in multiple other fields of use, including many applications for closed-loop neuromodulation.

CONCLUSION AND PEARLS

The experience gleaned is not done justice by trying to summarize it in a paragraph or two, but I will attempt nonetheless. First: focus on important problems that impact people. This is good in and of itself, and ventures working on high impact solutions are easier to recruit bright people to join. Second: be a sponge for advice. Entrepreneurialism, like all fields, can and should be a lifelong learning experience. Particularly for first-time entrepreneurs, building a trusted set of seasoned advisors can be invaluable. Third: obtain robust patent coverage of the product, and understand the landscape. Fourth: recruit seasoned people, especially ones with backgrounds that round out relative weaknesses of the founder or the early team. Hire very bright people and people who know how to recruit more very bright people. Fifth: find investors with familiarity with space and its inherent risks and with sufficient capital to carry the project over the finish line. Find investors who have great reputations and who are founder friendly. I will share my mantra which applies not only to new projects and ventures but, I believe, to undertakings in general is: “(1) Pick a topic that you are passionate about and that will have impact, (2) assume that you will succeed, and (3) work like a dog to insure the first two assumptions hold.”

Financial support and sponsorship

Nil.

Conflicts of interest

There are no conflicts of interest.

Disclaimer

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of the Journal or its management.

References

1. Cook MJ, O’Brien TJ, Berkovic SF, Murphy M, Morokoff A, Fabinyi G. Prediction of seizure likelihood with a long-term, implanted seizure advisory system in patients with drug-resistant epilepsy: A first-in-man study. Lancet Neurol. 2013. 12: 563-71

2. DiLorenzo DJ, Leyde KW, Kaplan D. Neural state monitoring in the treatment of epilepsy: Seizure prediction-conceptualization to first-in-man study. Brain Sci. 2019. 9: E156-

3. Daniel JD.editors. Apparatus and Method for Closed-loop Intracranial Stimulation for Optimal Control of Neurological Disease. US Patent, No. 6,366,813, Filed June 25. 1999. p.